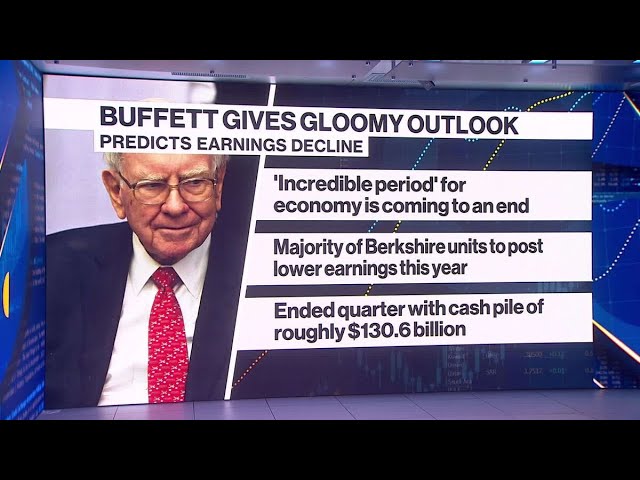

Buffett Predicts Earnings Decline at Berkshire Units

And of course, this coming at their annual AGM. Yeah, a prediction of an earnings decline gets a lot of attention because Berkshire Hathaway's conglomerate with railroad, retail, insurance, energy utilities is seen as a proxy for the US government economy in general. And the outlook from Buffett is simple yet gloomy. For his own businesses, he's pretty much saying the good times may be over. He told the crowds gathered in Omaha that quote, the incredible period for the US economy is coming to an end, that the majority of Berkshire units will likely report lower earnings this year than last. And this comes on the heels of reporting an almost 13% gain in operating earnings in the first quarter and topping off the cash pile, ending the quarter with more than 130 billion. So it's coming off a very strong quarter.

Still Buffett said he expects earnings at its insurance underwriting operations to continue to do well. They're not as tightly tied to business activity. The auto insurer Geico, for instance, already reported higher earnings, swinging to profitability after six quarters of losses. Other parts of the conglomerate took hits those, such as energy, falling more than 46%, and the railroad unit coming in weaker than expected. Notably, Berkshire brought back 4.4 billion of stock. That's an increase from this time last year.

And some analysts thought it was very noteworthy that they won't be making an offer for full control of Occidental Petroleum. As noted, Greg Abel named Air Apparent in 2021 was reaffirmed over the weekend. And Buffett says he expects that whenever he steps down as CEO, that's a big question. It will be business as usual in terms of transition. Buffett also had strong views when it comes to the banking turmoil and the debt ceiling. Yeah, he definitely wants bank executives held accountable. And he pointed in particular to First Republic, calling their loan practice of offering jumbo non-government backed interest rate from 10 years, fixed rate loans, a crazy proposition.

And said that the bank was, quote, doing it in plain sight and the world ignored it till it blew up. First Republic, of course, collapsed last weekend. The FDIC took it over, JP Morgan took it off the hands of the FDIC, and Buffett also called what he says messed up incentives in banking regulation part of the problem, as well as poor messaging by regulators, politicians and press, he said to the public about what he's referring to as the banking turmoil. As for the debt ceiling, he had words to say about that as well. Although he says he can't imagine a scenario where US lawmakers will allow the US to default on debt, which of course would be disastrous for the US economy.

Bloomberg