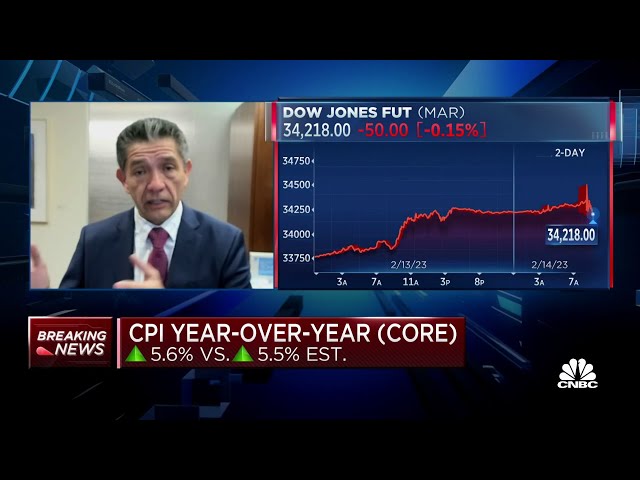

New CPI data gives the Fed more ammunition to continue tightening, says Schwab's Omar Aguilar

Do you consider this morning's number sort of a push or are some marginal improvement in the inflation picture? Well, it's it certainly More of a push and certainly more of a tie between the dovish and the hawkish, you know views in the market today Like you can basically take any side and look at this report to confirm your views one way or another On the one hand, you know the report suggests that inflation still high and and therefore that gives the Fed and all You know old Fed officials, you know more ammunition to continue its hiking, you know path On the other hand, you will basically say that the long-term trend on inflation is coming down And therefore, you know the possibility that the economy will stay in a soft landing will probably be the best case scenario So you can actually basically play both sides Do you are you a proponent or a follower of this view that getting to four? Let's say I can be done but getting to two will be a multiple In terms of difficulty and if so does the market have a moment of clarity when when they come to the realization that that may be the case Well, we have like several forces on the on this car You know on one hand we have the market dynamics that basically tells on the equity market, you know They basically giving us one particular view of what this might look and what that basically tells us is that it probably thinks that the Rate or we're gonna get to that 2% is gonna be faster and and certainly the equity market seemed to be fairly optimistic At least up to yesterday who basically think that yes We're gonna be in the soft landing or no landing scenario on the other hand You have the bond market and the bond market is giving us a very different picture The big very very much in the in the camp of an inverted yield curve that is really really, you know historically, you know High and that widen between the 2s and the 10s that basically suggests that there will be a recession and therefore the Fed will probably Need to just stay a little bit aware of the financial conditions And then the last thing you have is the economic data and as we said, you know and look at this morning data That would suggest that the pace for getting to that 2% is gonna take longer So our point of view is that because we have these rolling, you know pieces of the economy moving That this gonna probably take some time before we can get down to 2% Maybe just to get to 3 to 4% you know at some point during this year, but it's gonna take much longer to get to that 2% Omar, where does that leave you though in terms of trying to assess the risk reward when it comes to things like equities if you feel as if That they've priced in a pretty friendly scenario by now And you think the bond market is taking issue with that Well, you know, certainly, you know the equity market, you know has These particular Characteristics of look true and trying to extrapolate the future, you know probably down the road regardless of what how long the economy and the Economic data actually takes to to look so it's usually ahead of the curve now The challenge with that is that you know in order for the equity market to be a little more clear on where that is gonna go We need a little bit of a stability and I think from our point of view, you know the stability of yields in the bond market It's exactly what will probably determine that inflection point because if you look at just the 10-year yield and the volatility of that 10-year yield Just in the last couple of weeks It's just being you know incredible to actually just see how much and how fast that moves and it's not until we get a little more Stability of those yields and therefore prices to actually on inflation that will actually gonna get a better sense of where the market So we expect more volatility in equities until we'll get more stability on bond yields and a little more clarity on this rate of inflation decay So does that mean that at this point that you are not warming up to increasing your weight? Let's say in equities are these we mentioned some of these six months t bills. Is that remain a nice place to park? You know, I think the the ability for us to actually just open the the possibilities if you know We have been discussing these, you know, even from the last quarter in the fourth quarter We say like Tina is pretty much dead and now, you know, it's open up to a lot of really good possibilities You know the yields that you get on the short part of the curve of fixed income is something that you know It's very open now that we didn't have before and you actually wait probably for you know 12 months to 18 months You're probably not gonna get as much as you can actually get today So in in many cases opening up to different diversification options including bonds, you know It's probably more open than not Right. I always think back to the time where there was no alternative. Certainly not the case arguably today Omar Thanks so much. Good to see you. You.

Squawk on the Street, CNBC, business news, finance stock, stock market, news channel, news station, breaking news, us news, world news, cable, cable news, finance news, money, money tips, financial news, stock market news, stocks